AED

WHITEPAPER

by

PT MITRA GLOBAL INVESTASI

01 Executive Summary

Welcome to the future of mining! The advent of blockchain technology and smart contracts has stimulated breakthroughs in many industries, triggering rapid transitions in operations across the globe. The mining sector could benefit immensely from facing the challenge of integrating digital innovations. We have developed the novel approach to this challenge, bringing together decades of experience in mining operations and value chain monitoring with maverick, cutting edge technological solutions. Such an approach will pave the way for a new wave of mining innovation and investment opportunities.

1.1 AED Protocol

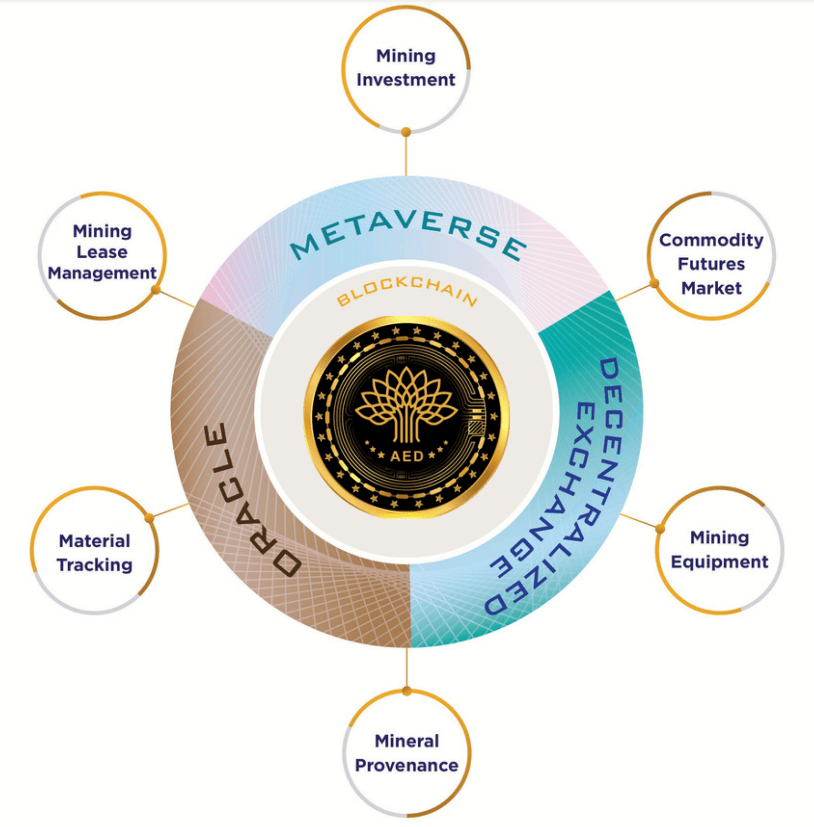

In order to fulfil the mission to digitally transform the mining industry across its value chain, the AED protocol has been built. Blockchain technology presents massive potential for improving existing processes. Moreover, it can make the chain of operations more efficient, in turn providing avenues to reduce costs. Along with this, blockchain offers greater transparency and democratises access to investments in the mining industry. We have identified various areas within the industry which are still lagging behind in terms of digitalisation. The areas listed below can be reinvented through implementation of blockchain technology.

- Mining Investment

- Mining Lease management

- Material Tracking

- Mineral Provenance

- Mining Equipment

- Commodity Futures Market

1.2 AED COIN Token

AED COIN (AED) is an ERC20 utility token that serves as the currency in the AED protocol and its ecosystem. AED COIN Token holders will be able to use the token in all future projects which will be gradually implemented across the mining industry and the met Metaverse, Oracle and Decentralised Exchange. The expansion roadmap needs cooperation from our partners, whereby AED will play a key role in incentivising and aligning the interests of all parties involved. The value of AED will rise when usage cases and platform demand increases. The underlying value of the token comes from a revenue capture model and governance system.

- Transaction: Used in purchasing products & services within AED Mine ecosystem.

- Revenue accural: Fees and income generated within the protocol will be accrued in treasury.

- Governance: Participating in voting to determine protocol direction.

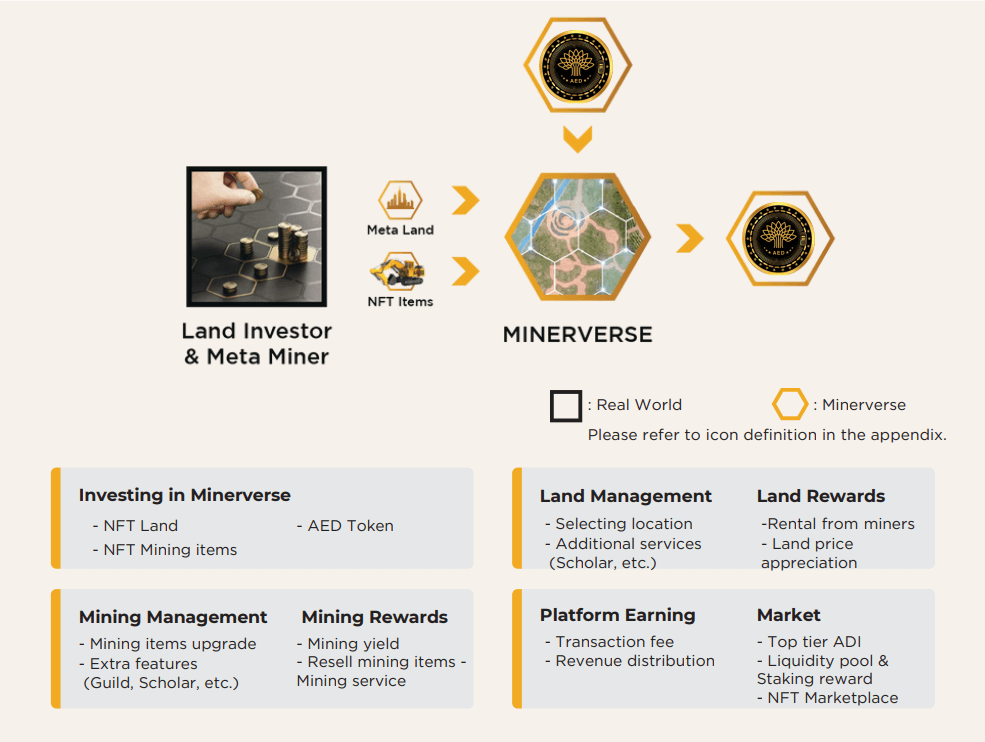

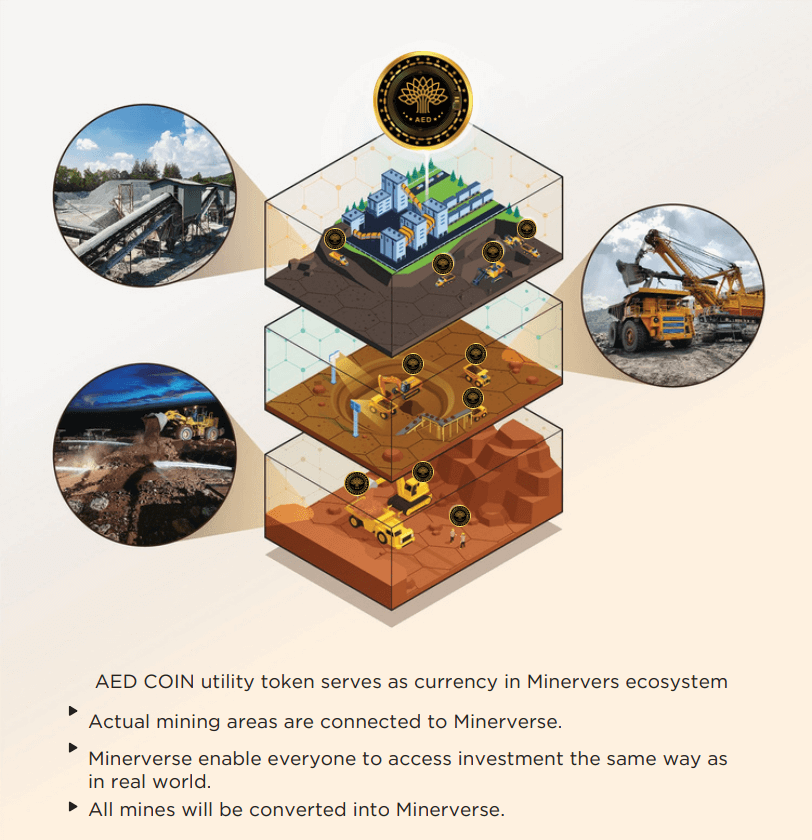

1.3 Minerverse Platform

Minerverse is the first project of the AED protocol. Minerverse represents a decentralised platform designed for investment in the mining industry as next generation DeFi. In contrast to existing DeFi protocols, where investment has no real assets back-up, Minerverse connects investors to revenue from mining operations in the real world as the assets. As such, revenue earned through Minerverse is “REAL” unlike the deeply theoretical aspects of other metaverse activity. The platform will enable retail investors to conveniently access and smoothly earn from real-world mining, sidestepping traditional complications. The world of mining is vast, with an extensive variety of minerals which can be traded. There are many possibilities for users to explore, gaining exposure to the industry and providing them with a refreshingly positive experience of the mining industry.

The Minerverse Ecosystem lets you invest in real mining business.

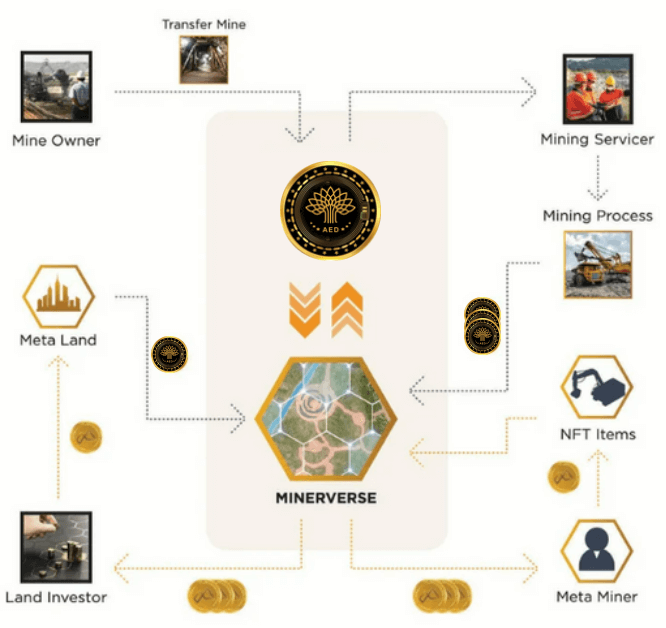

In order to achieve the goals mentioned above, the “PT. ASET DIGITAL INDONESIA” company has been established. The company will act to benefit the platform, acquiring real mines and contracting specialists to offer mining performance as an end-to-end service. Meanwhile, those investors who want to gain exposure can choose to become either Land Investor or Meta Miners, undertaking different roles to emulate real world ‘risk & reward’ models.

Participants in Minerverse Ecosystem.

-

ADI

PT ASET DIGITAL INDONESIA is a private company registered in Jakarta, it operates Mining-as-a-Service and has a pivotal role in overseeing the operation of both mining and platform administration -

Mining Servicer

Strategic partners who will perform end-to-end mining services, from mineral extraction through selling of the mineral. One such strategic partner is PT. FORTUNE BORNEO RESOURCES., Established since 2011 Gold Mind Permit Holder (IUO-OP) in area 3600Ha. Located in West Borneo, Indonesia. -

Meta Miner

Users of Minerverse platform who believe and seek investment yield from mining in real-world, accessing the desire through the metaverse. -

Land Owner

Long term investors who prefer stable income from leasing, and increasing in land values compounded by the growth of the platform. -

AED Token Coin Holder

A collective owners of the platform who will form and act together in control of decentralized autonomous organization (DAO) which is driven by voting system.

1.4 Minerverse Framework

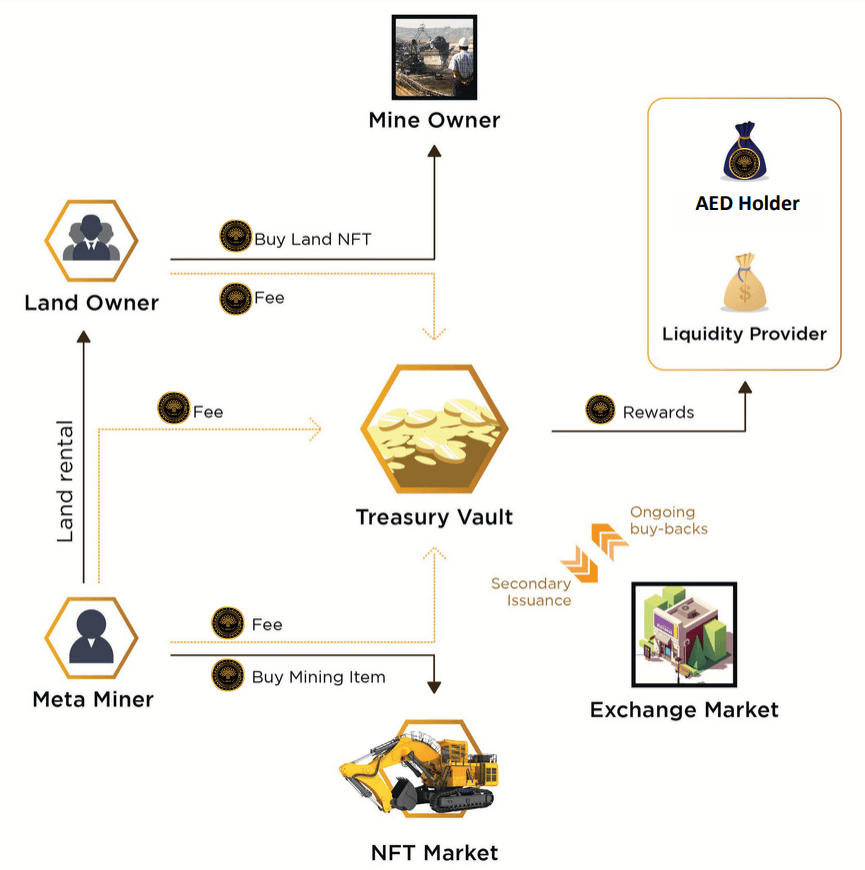

The Minerverse framework defines each of the processes necessary for implementation. This consists of mine acquisition, mining servicer engagement, revenue transfer to the platform, and management of the Minerverse

- Minerverse is operated by PT.ADI, who will acquire the rights over mineral extraction revenue from the mine owners. The funds for mine acquisition will predominantly come from the sale of land in advance of operation to Land Investors.

- After securing the mining rights, PT.ADI will engage strategic partners specialising in mining services. They will perform the end-to-end tasks of a mining operation, right up to the sale of extracted minerals on the market and the transfer of accrued revenue to Minerverse platform.

- Mineral revenue is stored in Minerverse’s vault and is ready to be mined. Meta Miners then require mining items and land or land rights in order to start mining, the yield from which will be drawn from the vault. In addition to these actions, a Land Investor can earn income from rental fees.

- The Minerverse platform will collect transaction fees from each process on the platform to remunerate for the costs of acquiring mines and undertaking mining operations. The revenue is then accrued in the treasury for further use to the benefit of the platform owners.

Revenue transferred into Minerverse will be distributed to each participant in the platform.

02 Background

The mining industry is one of the most crucial sectors in our economy. Not only does the industry produce goods, but together with mineral extraction it provides services and contributes to infrastructure development, thus enabling improvements to our modern-day living standards. Mined materials are the essence of infrastructure construction projects such as roads, hospitals and schools. Without mineral extraction, industrial innovations we have come to rely on such as automobiles, computers and satellites would never have come to be. Furthermore, key utilities such as electricity generation depend on mining activity. As we progress through the digital age, the role of the mining industry has not diminished. However, it is true that the industry is going through an intense period of change, much the same as every industry the world over. New technologies and innovations must be harnessed to provide a high level of operational efficiency and sustainability.

2.1 PT. ASET DIGITAL INDONESIA

PT. ASET DIGITAL INDONESIA is a private company registered in Jakarta, the core business endeavour of which is mining-as-a-service. The company has been founded by a group of professionals spanning traditional business backgrounds within the mining industry and experts attuned to the digital world, spearheading the development of blockchain technology. The vision of the company is to create a hybrid economy in which the real world and blockchain can coexist and interoperate. PT. ADI pioneer project is the AED Protocol, which aims to transform the mining industry through the implementation of blockchain technology, culminating in the setup of a decentralised autonomous organisation (DAO) to guide the protocol. The first product of PT.ADI will be the Minerverse platform. Once created, PT. ADI will retain the pivotal roles of overseeing the operation of physical mining endeavours and administrating the Minerverse Platform.

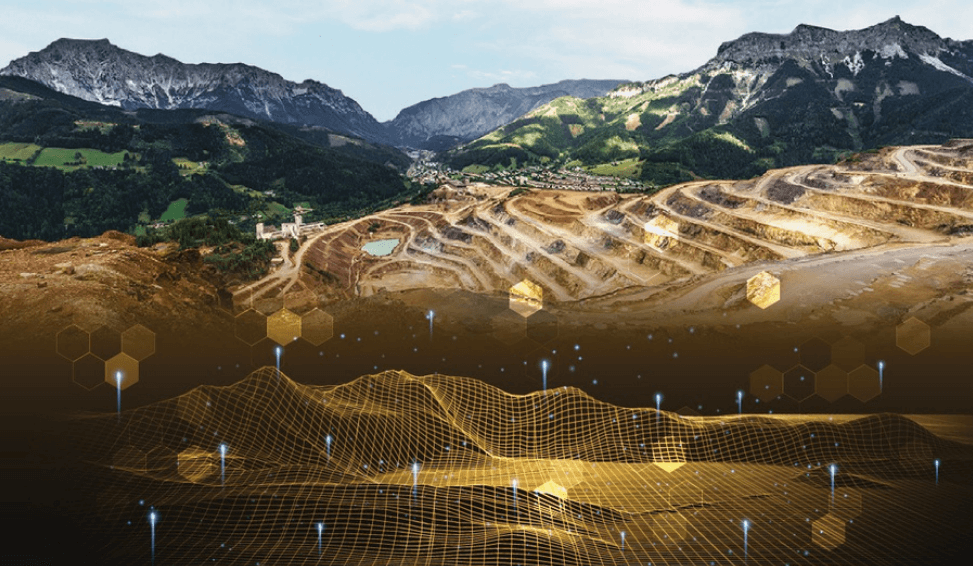

2.2 Strategic Partner

The crux of Minerverse platform is a collaboration with a specialised mining service company. A strategic partnership has been formed with PT. FORTUNE BORNEO RESOURCES, a firmly established mining operator based in Indonesia, and regional leader in the industry. The mining business entails extremely complicated processes, from exploration, analysis of mineral quality, explosions, mineral processing (ore dressing) through to import-export operations and sales. Each step needs expert supervision to minimise cost and time implications. These complexities truly warrant oversight from an experienced team that can use the company’s knowledge accrued from over 12 years of activity in the industry. “Fortune Borneo Resources” . is one of the oldest and most professional complete mining businesses in southeast Asia. The company boasts an arsenal of standardised machinery for efficient mining operations. Building on this foundational expertise, Fortune Borneo Resources executes operations for Gold. In order to achieve this Fortune Borneo Resources operates in Indonesia,

The key highlights of “FORTUNE BORNEO RESOURCES”s past performance of mining operations are as follows:

- Explored and operated gold mining in Mandor, West Borneo Province, Indonesia.The concession area covered 3,650Ha and has operated since 2011 of significantly anomalous gold deposits and gold-based metal minerals with flotation technology being subsequently implemented.

- PT. ADI is exhilarated with the opportunity to tap into the expertise of “FBR”. PT. ADI will seek various types of rights over mineral resources not only in Indonesia but also in regions across the globe. The primary targets will be in Southeast Asia and Africa. After securing the rights, PT.ADI will rely on PT. FORTUNE BORNEO RESOURCES (FBR) to bring the real world mining operations into the Minerverse.

03 Project Information

Blockchain technology presents both opportunities and challenges to the mining industry. Such seismic potential for change brings room to transform the industry in the near future. There are plenty of issues presented in the mining industry in its current state. Adding to the areas for improvement already addressed, there is a key issue in access to funding. Mining companies and mine owners are unable to reach the capital needed to further proceed and develop their projects, with bureaucratic licensing hurdles becoming a resource sink. Along with the digital revolution, social attitudes have begun shifting, with consumers and activists alike pushing for accountability and transparency from corporations. Addressing these factors will by proxy improve logistics and operational efficiency as cloak-and-dagger activities and abuses of power are increasingly shunned.

3.1 What is AED PROTOCOL?

“ THE METAVERSE HAS BECOME A REALITY. ”

AED protocol has been established with the mission to transform the mining business by leveraging the advantages blockchain technology brings, such as its transparency, trustworthy, mandated reliability, and security. The possible areas where blockchain can enhance the current process in the mining industry are as follows:

-

Mining Lease Management

There are approvals of documentation created during the exploration, resource/ reserve estimation, mine design and planning processes. The mechanism of custody and control needs to be traceable by proof of documents at every stage. Blockchain can improve the traceability of reserve estimation for reporting by utilising the concept of smart contracts which can also extend to external data providers (Oracle) and validators (nodes). This will ensure the correct workflow and auditing of activities and outputs used in the resource/ reserve calculations. -

Material Tracking

Blockchain has proved effective in tracking resource movement, which can be applied to materials along the mining value chain. This added transparency is beneficial in showing stepwise values for the provenance to relevant partners or customers. For instance, the ore may be assigned with a quality certificate and sent to a laboratory for reassurance testing, eliminating the potential for disputes over the ore quality. -

Mineral Provenance

Recently there has been growing concern towards manufacturing companies’ mineral sources. More and more companies have become rightly cautious and will avoid using minerals originating from prohibited areas, such as where there are issues of underpaid labour or neglect for environmental standards. The transparency provided by blockchain will help provide assurance to customers concerned with such matters. -

Mining Equipment

Mining equipment parts come from various vendor sources. The spare parts market is crucial but oftentimes highly stressful. Blockchain can be applied to this market to prevent used parts with a lack of ownership history or maintenance records from reaching operation, mitigating the risks associated through traceable contracts. The trackable records of spare parts could give insightful data and make the resale market even more efficient. -

Commodity Futures Market

For material trading, commodity futures, such as the London Metal Exchange (LME) are places for participants to buy and sell commodity and futures contracts for delivery on a specified date ahead of time. The traditional market is highly regulated and riddled with inefficiency, making trading laborious for consumers. Decentralised exchange is becoming popular due to its innovation and cost effective way of trading commodities at smaller scales. -

Mining Investment

Investment in mining generally requires financing a company’s entire operation. may need to bear both the overhead and general expenses, taking on the risk of underperforming areas. Blockchain technology can allow investors to participate in only preferred areas of markets using the pool staking concept, which can yield the highest risk-adjusted return.

3.2 Minerverse Ecosystem

Minerverse has been created to address one of the critical flaws of the blockchain space, in particular the lack of underlying value in the metaverse and DeFi. The metaverse has attracted enormous attention from around the world, with social discourse and economic activities increasing day by day. Nonetheless, in the current metaverse, there is no concrete concept of how assets accrued through metaverse activity can be brought into real world functions. Similarly for DeFi, Investment DeFi generally relies on the compounded return of digital assets, which in most cases have neither intrinsic value nor backed up physical assets which investors can liquidate their position into. Hence, the valuation of such investment can be sensitive to market movement, making it difficult for investors to manager their portfolio due to its unstable value. Minerverse is one of the first novel approaches that creates linkage between assets in the real world and the metaverse, using the framework of the mining industry. We believe that interactions tethered to physical assets will reinforce public trust in the concept of the metaverse. This in turn will instils greater confidence in Minerverse as the next generation DeFi. The platform enables everyone to have access to investing opportunities, not only in mining business, but also creating new asset classes which could add greater diversification to benefit their portfolio like never before. Participants in Minerverse are also free to take part in mining minerals of their choice, allowing them to evaluate and compare returns on extraction of gold or iron for example.

3.3 Minerverse NFT

In Minerverse, you can choose to engage in various roles to earn income from the platform, such as: A Land Investor, a ADI Miner, a trader or a holder of AED COIN tokens. ADI Miners earn income directly from the minerals they extract from the land. As for Land Investor, they can earn income from rental fees or appreciation of land prices. The traders help support market efficiency and earn from fulfilling demand and supply. Lastly, AED token holders, as the owners of the platform, can earn fee income from platform usage. As the platform grows, more and more users will start to interact with the platform and thus create a larger economy.

Mining-as-a-Service

Phase 1 - Land NFT

NFT Land comprises a wide range of territory of mining areas to choose from certain minerals as follow:

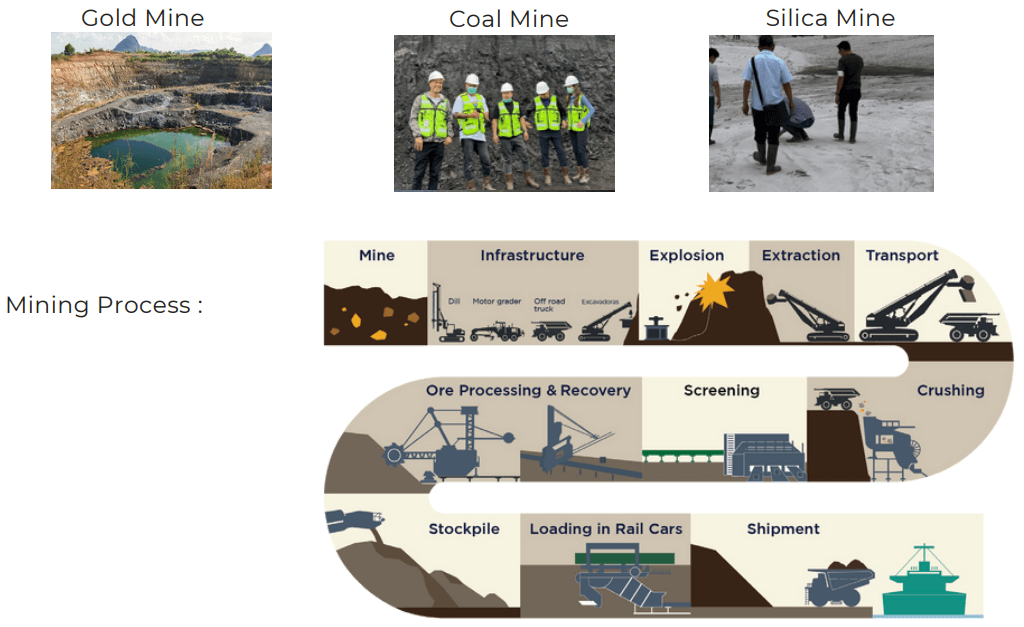

Mine Area List :- Gold Mine Area

- Silica Mine Area

- Coal Mine Area

The mining landscape is supplied by PT. ADI. The selected site would reflect and be created with the same attributes as the physical site. They will be linked in their size, geography and environment. Each mineral type will pose different benefits based on the actual market demands of the real world, responding to changes in the value of the material. The Land Investor can also rent out their space to other users or Meta Miners if seeking a more stable income from the platform. Since the price of minerals comes from the market prices in the real world, the demand movements for land in the Minerverse also correlate in the same way. When the price of certain minerals rises, income from sales would increase due to the attraction of more Meta Miners who will be willing to pay a higher land rental fee. Managing demand and supply along with the diversification of land areas is an important part of a successful Land Investor’s strategy.

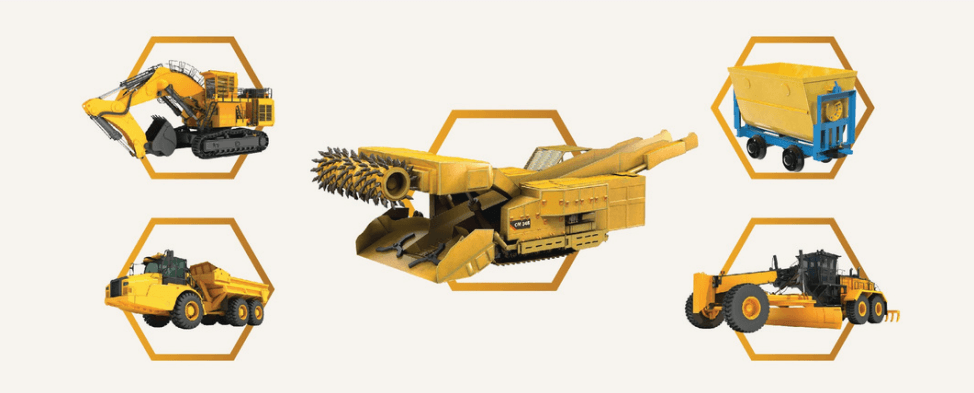

Phase 2 - Mining Items NFT

In order to start their business operation, Meta Miners must first purchase or rent land with the attached target mineral, and then buy mining equipment or ‘NFT mining items’. The income from mining will occur in real-time with the price varying based on the price of the mineral in the real world.

Other interesting features are the different classes of NFT mining items. As mining items get upgraded, their effectiveness will increase, benefitting the user. Thus, when there is high demand for specific minerals, the race to mine will drive demand for mining items. Users then can choose to upgrade their mining items and enter the rush, or trade their items to profit from the price increases seen in the item market.

Phase 3 - World of Miniverse

The Virtual world has become a reality

As the term ‘Metaverse’ becomes commonplace in today’s social reception, we have started to understand it as a tool for communication, interaction and forming relationships, unbounded by traditional physical barriers. It is this breakdown of barriers that has ushered a paradigm shift in economic models, where an online space has the potential to capture real value. Minerverse aims to be a pioneer of this economic force the digital world has borne. As our model matures and becomes more advanced, it will reach a point where new economic activities arise out of the initial business model of mining in the Metaverse. Users will be able to produce their goods and services; corporations may seek to tap into the user base, opening online stores or promoting their brand. Even financial institutions may initiate their own new form of banking or insurance business model. Minerverse will begin monitoring activity and build additional features on top of the solid core model of mining. Land scarcity and tradable mining items can be harnessable tools, producing endless possibilities for Minerverse interactions.

04 Economy

The value of the AED token increases with the growth in Minerverse economic activities. Fundamentally, AED’s value is driven by demand in platform usage, trading activities, staking and revenue accumulation in the treasury, which will be distributed back to platform owners. The revenue capture process from real world mining to MYMine token holders can be shown in this section.

4.1 Mining industry overview

The mining industry involves exploring, processing and manufacturing value-added products from various minerals. These minerals are subsequently used by many industries, from energy generation to construction, as well as cosmetics, fertilisers and food. The mining industry enables us to obtain the minerals necessary to produce such important commodities. Gold, Coal, and Silica are essential to this day and as such, so is mining. Mining is secure in its profitability due to these factors, as the growth of other industries and our everyday lives is dependant on it.

Example type of miner as following :

The process of selling minerals in the market There are different methods and procedures for the extraction of each material, the intricacies of which are not to be understated. The infographic briefly explains the general method of our strategic partner. You can see the flow of classic mining operations, from selecting the potential area, levelling of the site to be mined, explosion and extraction, crushing and screening to reduce the material to suitable sizes, through to ore processing, recovery and stockpile holding, and finally to rail shipment from the site to eventual mineral sales. Once the extraction process is completed, mine closure and rehabilitation activities will commence to prepare for post-closure mine site reuse. Reclamation, restoration and revitalisation will bring the environment back to a desirable state.

4.2 Core Components

The value of AED increases with the growth of Minerverse and the increasing frequency of trades. Fundamentally, AED’s value is driven by demand in the platform’s usage, stake, and revenue accumulation in the treasury. The treasury will help to mediate demand through its burning mechanism. At the core of the Minerverse platform, there are four components designed to interact in order to maintain a sustainable and dynamic economy.

Revenue Capture Model

The platform generates revenue from selling NTFs and from transaction fees. Each transaction in Minerverse will incur a small fee charged to the platform, which will be reserved in the treasury pool and foundation pool. The majority of the revenue collected will go to the treasury pool which will be distributed to the benefit of token holders. The rest will go to the foundation pool which will be used to support longterm protocol development. Ideally, the use of this pool will be delegated to the DAO’s decision.

Initially, revenue capture comes from :- NFT SALES : NFT sales in the form of land and mining items. Revenue capture from these sources will be allocated predominately to mining operation expenses. The profit incurred from these activities will be retained in Treasury and Foundation pool.

- Transaction fees : There is a fee charged to each transaction on the platform, such as NFT sales, collection of mining rewards and land rentals.

- Extra services : As the platform grows, new services will be introduced to provide greater rewards, risk management, or even more specialised and custom-built business opportunities. These could include subscription models, commission models, or insurance plans. The possibility for further revenue streams such as advertising can be categorised through extra services implementation.

Mining operation

The main expense beside platform development will be the costs incurred from mining operations in the real world. Those costs comprise the acquisition of a new mine and a management fee paid to the mining service partner. Funding of these activities will be managed through the sale of NFTs.

Burning mechanism

As revenue flows into the treasury pool, the balance between AED circulated within the platform and AED in the reserve will be monitored. Excess reserves in the treasury will be used to buy AED in the open market for burning. This will create demand for AED and increase its scarcity.

Treasury pool

The pool operates in a way that is similar to the role of a central bank. The treasury aims to ensure the stability of AED value by using tools such as liquidity management, the burn mechanism, and the release of reserve AED when new mine sites are acquired.

Foundation pool

The foundation pool will be utilised for the continuing development of the platform. This will be actioned internally through additional aspects as well as eternally though business partnerships and marketing outreach.

| Activities | Description |

|---|---|

| NFT Sales | Initially, will be paid for acquiring a new mine and mining service partner will be paid. Excess profit 90% goes to Treasury, and 10% goes to Foundation. |

| Transaction fees (3%) | Fees are charged to the platform whereby 70% goes to Treasury, and 30% goes to Foundation. |

| Extra services | 90% goes to Treasury, and 10% goes to Foundation. |

Revenue circulation in the platform via AED flow can be illustrated in the following graphic. From the left revenue generated in many forms will be collected through the platform and kept in the treasury, which will be used as rewards for liquidity providers and also be distributed to AED token holders.

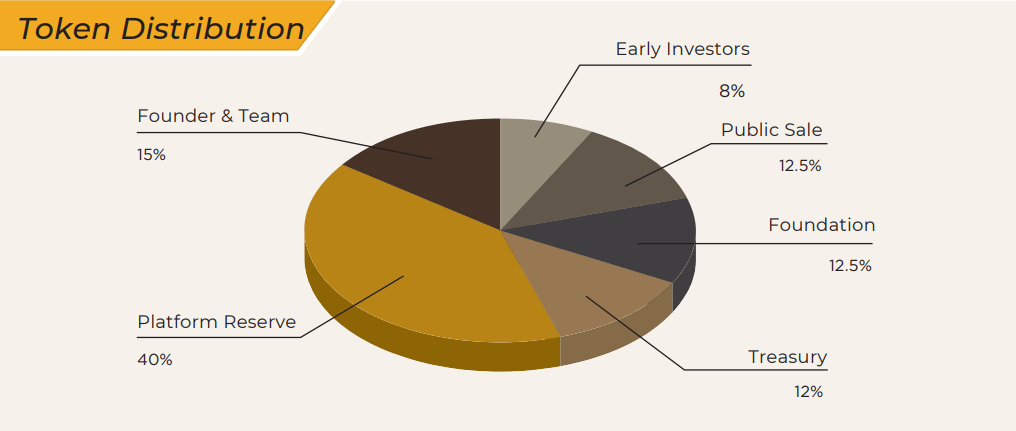

4.3 Tokenomics

AED has two purposes in the platform; 1 : To serve as the main platform currency 2 : To act as a governance tool The Minerverse platform is built initially on BSC but will follow ERC-20 standards, with aims to be multichain in the near future. The total supply of AED is capped at 1,000,0000,000 AEDs.

| Token Allocation | Amount | Percentage | Objective |

|---|---|---|---|

| Early Investors | 80,000,000 | 8% | Setup operation & ecosystem |

| Public Sale | 125,000,000 | 12.5% | |

| Foundation | 125,000,000 | 12.5% | Community 10%, Marketing 40%, Partnership 40%, Development 10% |

| Treasury | 120,000,000 | 12% | Liquidity management and reserve for PT.ADI. |

| Platform Reverse | 400,000,000 | 40% | Rewards and ecosystem |

| Founders & Team | 150,000,000 | 15% | Core members who help launch initial version of protocol. |

| Total | 1,000,000,000 | 100% |

4.4 Project Funding for Developments

| Token Allocation | Private Sales |

|---|---|

| Mine acquisition | 5% |

| Misc administration | 5% |

| Hardware & Software | 10% |

| Community & Marketing | 10% |

| Commercial & Operating | 20% |

| Technical developments | 50% |

| Total | 30,000,000 |

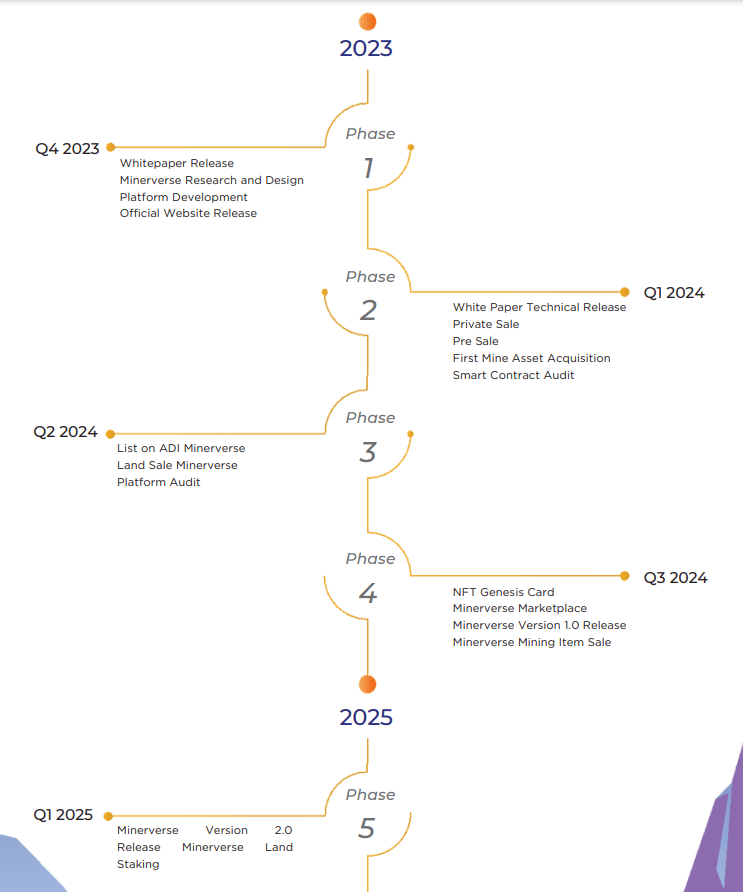

05 Project roadmap

06 Team Information